What Is Integrated Financing for Furniture Retail Software?

When a retailer offers third-party financing, it partners with lending institutions to fund customers’ orders while the customers complete a payment plan with the lender. Some retailers choose to offer in-house financing options, where they hold their own paper and provide credit through installment contracts or revolving branded credit cards. By integrating these programs into your Point of Sale and Accounting solutions, you can effectively manage your customers’ lines of credit, accounts receivable, and collections.

Integrated Third-Party Financing Software

Partnering with third-party financing lenders helps your customers pay for the merchandise they want while removing the liability of managing credit within your retail business. Once your customer is approved for third-party financing, the chosen provider will handle their payment plans directly. STORIS’ integrated third-party financing solution manages all touch points with finance lenders including application, approval, authorization, settlement, and account reconciliation. STORIS’ finance estimator tool enables customers to choose from the most desirable plan the provider has approved them for, giving them greater buying power.

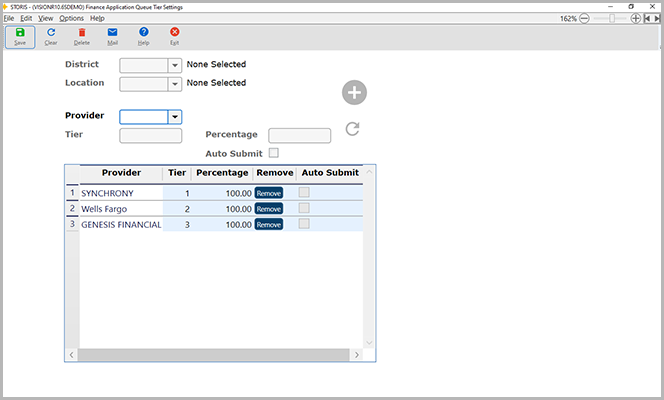

Third-Party Finance Queue

With the Finance Queue, a single credit application can be submitted against the retailer’s available options for primary, secondary, and tertiary lenders with the customer’s approval. This fast-tracks the application process while getting customers more successful approvals and higher lines of credit.

Consumer Credit Application

Consumer Credit Application integrates the consumer finance application process for either in-house or third-party financing by collecting customer information and transmitting it directly to certified credit services or lenders. This provides the retailer with settlement and account reconciliation to STORIS Accounting & GL.

Customer Facing Application

Customer Facing Application (CFA) promotes security and privacy when collecting sensitive customer data through a mobile-responsive, web-based application. This information was formerly dictated to a retail associate, which ran the risk of being insecure and uncomfortable. Now, customers enter their data while in a retailer’s showroom. Retailers can add instructions to guide the customer through this self-service process available for in-house and third-party financing. CFA delivers a positive customer credit application experience for all parties and can be used along with the Finance Queue for added convenience. Available as a companion module in customized solution packages.

Versatile Credit via STORIS APIs

Retailers can also integrate to a third-party provider for self-service applications and waterfall processes via STORIS APIs. Today, we partner with Versatile Credit enabling retailers to offer cascading mobile applications and use Versatile’s patented “Snap to Apply” technology to apply for furniture financing from the comfort of their mobile device.

Advanced Receivables for In-House Financing

With In-House financing, the retailer acts as the lender and enables their customers to make monthly payments directly to their retail operation. STORIS’ In-House financing software allows for the automated processing and cycling of customer payments while adhering to the compliance associated with the Truth in Lending Act (TILA). Easily build and maintain your own in-house financing plans, manage payment schedules and interest rates, and track promotions.

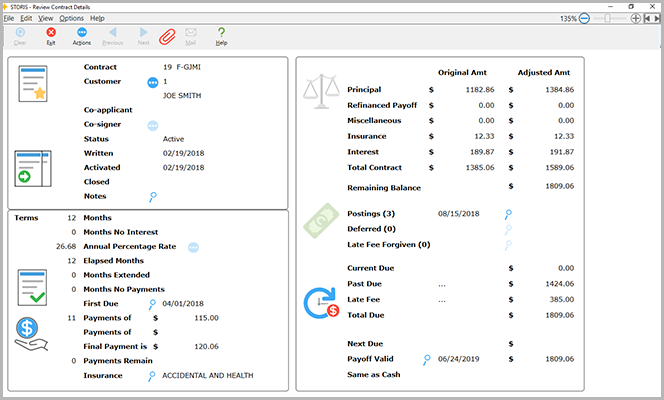

In-House Installment Receivables

Installment Financing is a one-time loan agreement that is created and maintained by your retail business directly with your customer. This includes managing contract terms and conditions, amortization schedules, activation and expiration dates, and payment periods. Further, you can offer insurance as a means for your customers to protect their loans. With STORIS’ Installment Receivables, you can activate, delete, cancel and reinstate plans as well as offer refinancing, extend contracts, defer payments, and adjust due dates all from one comprehensive screen.

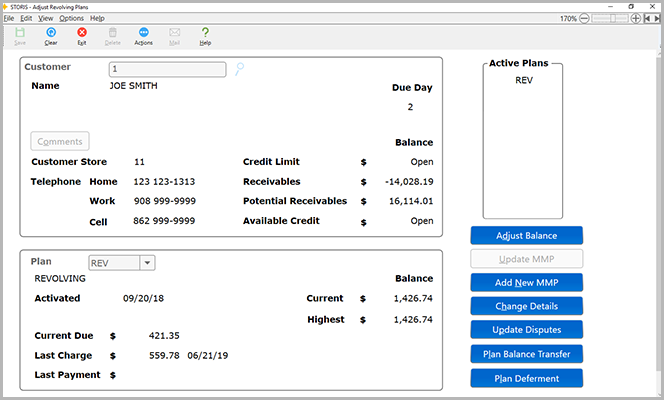

In-House Revolving Receivables

Revolving financing enables you to offer renewable lines of credit on a monthly basis, such as branded credit cards. Automatically cycle customer payments based on the specific requirements of your business. Choose from interest rate options using credit scores. Additionally, limit the ability to offer payment plans and promotions to corporate, franchise, or specific store locations.

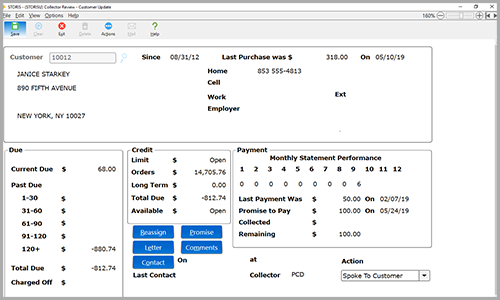

Collections

The Collections module enables retailers to manage customer debts, track account history, assign “Promise to Pay” & “Call Backs”, and create collection letters. Assign late fees and utilize the Repossession Tool to calculate inventory depreciation. The Collections module can be used by your agents to prioritize daily calls for customers with past due balances and efficiently apply payments to their accounts.

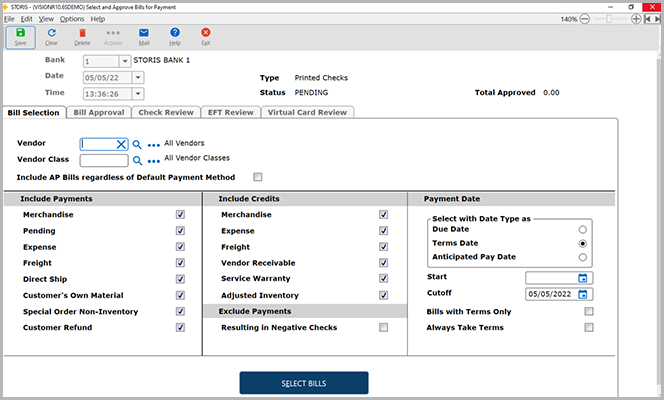

Accounting Software

STORIS’ integrated furniture accounting software automates accounting and financial tasks across Accounts Receivable, Accounts Payable, and General Ledger. Direct integration makes managing your a more precise.

When you choose , you get more than an industry-trusted retail software solution. You get the know-how of our team of experts, superior service, and opportunities for growth. Use the form below to learn what can do for you.

When you choose , you get more than an industry-trusted retail software solution. You get the know-how of our team of experts, superior service, and opportunities for growth. Use the form below to learn what can do for you.